During 2012 there will be multiple changes to the Feed-in-Tariff for solar panels. From March the rate is 21 pence per kWh, although this will drop two times later in the year. Also there are energy efficiency requirements from April. CompareMySolar explains the changes.

During 2012 there will be multiple changes to the Feed-in-Tariff for solar panels. From March the rate is 21 pence per kWh, although this will drop two times later in the year. Also there are energy efficiency requirements from April. CompareMySolar explains the changes.

Explanation of the new Feed-in-Tariff

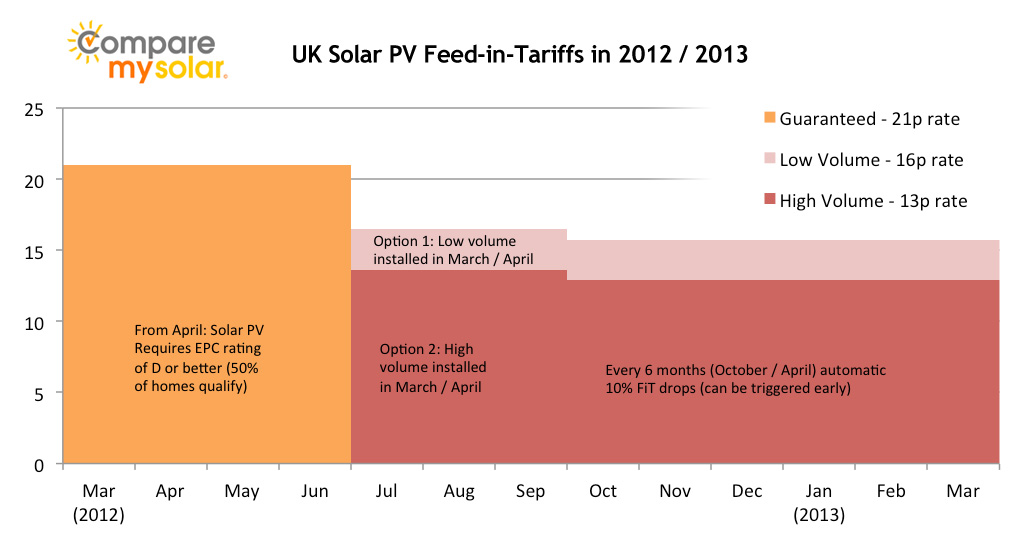

For every kWh generated by your solar panels you will receive a government incentive called the Feed-in-Tariff. This incentive is guaranteed for 25 years, tax-free, and will rise in line with inflation. Any solar panels installed after the 3rd of March 2012 will receive a rate of 21 pence per kWh. This rate is only valid for systems smaller than 4 kWp, otherwise you’ll receive 16.8 pence. Your solar installer has to be MCS accredited to be eligible for the Feed-in-tariffs. All installers on CompareMySolar are MCS accredited. The Feed-in-Tariff will change further during 2012 in the following months (see graph for overview):

- March: FiT set at 21pence per kWh, all houses eligible

- April-June: Feed-in-tariff remains at 21p, but houses require and energy efficiency (EPC) rating of at least D

- July-September: Feed-in-tariff drops to 16.5p per kWh or 13.6p based on volume on installations in March / April, we expect 16.5p since installed volumes will be lower than before

- October-March: Feed in tariff drops another 5% from July level

Besides the FiT your solar panels can have two other sources of financial return: electricity savings and the export tariff. For each kWh that you generate, you can either use it in your own house or export it back to the grid. When you use the electricity in your house you save yourself the electricity price (currently about 15 pence per kWh). When you don’t use it in your house you receive the export tariff (currently about 3 pence per kWh). Hence it is optimal to use most or all electricity generated in your own home. We will illustrate the financial return in the next blog post.